Compulsory PSC Register to be filed with Companies House from 30 June

The People with Significant Control Register (PSC Register) was introduced by the Small Business, Enterprise and Employment Act 2015 (SBEEA 2015) and is designed to improve transparency and trust in corporate structures and to help combat corporate crime.

We have set out below an overview of the PSC Register which we hope you may find helpful in complying with the new regulations.

- The PSC Register is designed to list People with Significant Control (PSC) over a company.

- Since 6 April 2016, Companies must have created and be maintaining their PSC Register. From 30 June 2016 Companies are required to provide this information to Companies House when they file their Annual Confirmation Statement (which replaces the Annual Return). Unlike the Annual Return process, there is no deadline for delivering an Annual Confirmation Statement but you must file at least one statement every 12 months. Companies will have 14 days from the date they choose to complete their statement to deliver their statement to Companies House. Your first Annual Confirmation Statement should be filed within 14 days of:

– The anniversary of company formation

– The anniversary of the made-up date of your last return

The filing fee to Companies House is yet to be confirmed but is unlikely to be more than the current Annual Return fee which, if submitted electronically, is £13. You can update the information on the Confirmation Statement as many times as you want with no additional fee involved.

- The Register must record details of legal persons with significant control over the Company (PSC) and/or other relevant legal entities (RLEs).

- A person with significant control of a Company is someone who:

(1) Owns more than 25% of the shares in the company

(2) Holds more than 25% of the voting rights in the company

(3) Has the power to appoint or remove a majority of the board of directors

(4) Has the right to exercise significant influence or control over the Company

(5) Has the right to exercise control over a company or trust that meets one of the other 4 conditions.

- A Company must take reasonable steps to identify its registerable person(s) who in turn are also obliged to provide confirmation of the information to be recorded on the PSC Register. Failure to comply is a criminal offence which on conviction could lead to fines and/or imprisonment of up to two years.

- If information is not forthcoming, a ‘Restrictions Notice’ can be imposed on a person’s interest. An interest which has had a Restrictions Notice applied cannot be transferred, cannot exercise any rights (e.g. voting rights), no shares may be issued in respect of the interest and no payment can be made in respect of it (i.e. dividends).

- The Company must continue to update its Register which will act as an active and evolving source of information. The Register must never be blank. There is official wording which must be used to record entries on the Register.

- The historic information must remain on the PSC Register for a period of ten years from the date of cessation.

- The rules in relation to the PSC Register, differ slightly depending on the entity involved (i.e. LLP, RLEs etc) and you should be careful to apply the correct approach to each entity.

- The Company must record information on the PSC Register with the correct type of particulars (depending on the entity) and using the ‘official wording’.

A copy of the official wording can be found on annex 2 of the Government’s Guidance booklet at the following link: https://www.gov.uk/government/uploads/system/uploa…

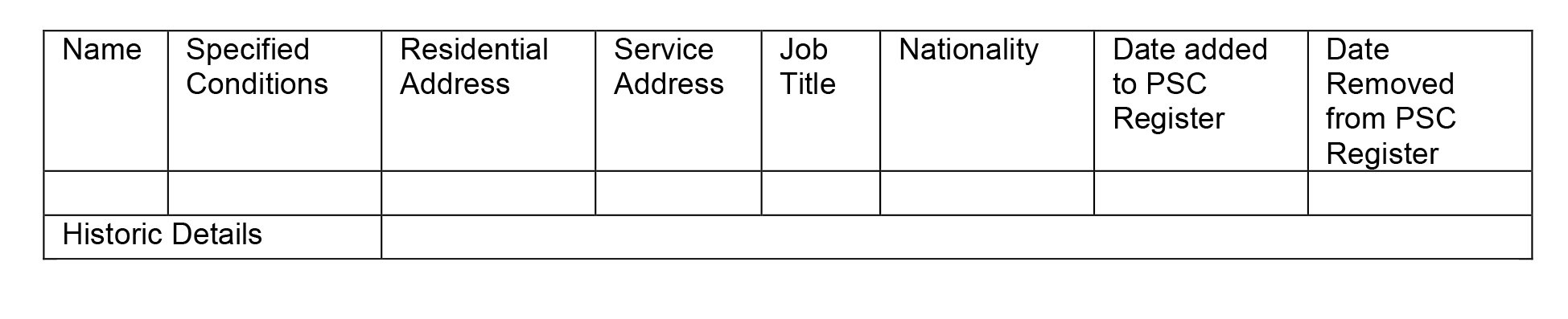

The format of the PSC Register and detail required will depend on what entity you are recording. The below example deals with an individual PSC.

The completion of a PSC Register is relatively straight forward task where the company structure is ‘simple’. For example, where a company has just one or two shareholders who jointly control the company. However, the completion of the PSC Register can be more complex and you should seek advice where you are uncertain, but in particular where:

– Shares are held by trustees;

– Where shareholders with less than 25% are connected with other shareholders (i.e. husband and wife);

– Where shares are held by oversea Companies;

– Where different classes of shares give different rights (other than just dividend rights);

– Where Articles or Shareholders Agreement or other agreement gives an individual or entity additional rights of control over a Company.

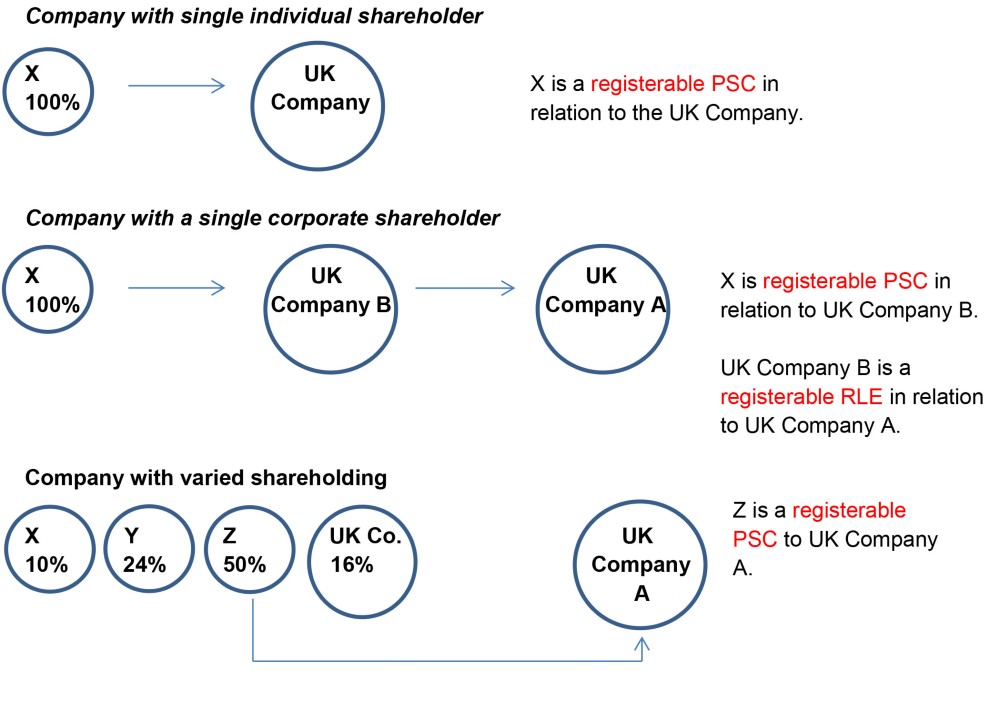

- Examples – Registerable interests**

**When determining the registerable interest, you must also consider whether anyone has actual exercise or right to exercise significant influence or control over the company.

Tags: Business, Companies House, Corporate, Lawyers, PSC Register, Solicitors

How can we help?

If you have an enquiry or you would like to find out more about our services, why not contact us?